- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Red light, green light - North America's auto industry future

A new vendor tooling study identifies some major obstacles ahead for North America’s auto industry — and a few ways to get around them.

- By Canadian Metalworking

- June 16, 2014

- Article

- Automation and Software

A serious vendor tooling capacity constraint will hit the North American automotive industry by 2018, a new report concludes, and it’s going to affect the entire value stream from vendor tooling suppliers to Tier 1 suppliers to original equipment manufacturers (OEMs).

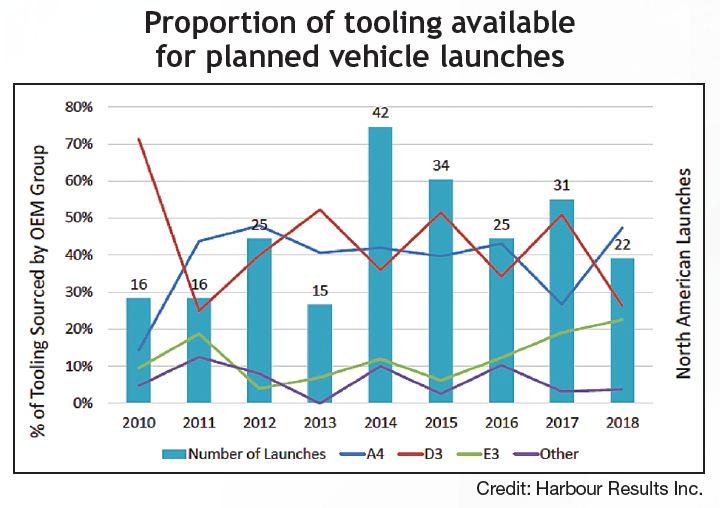

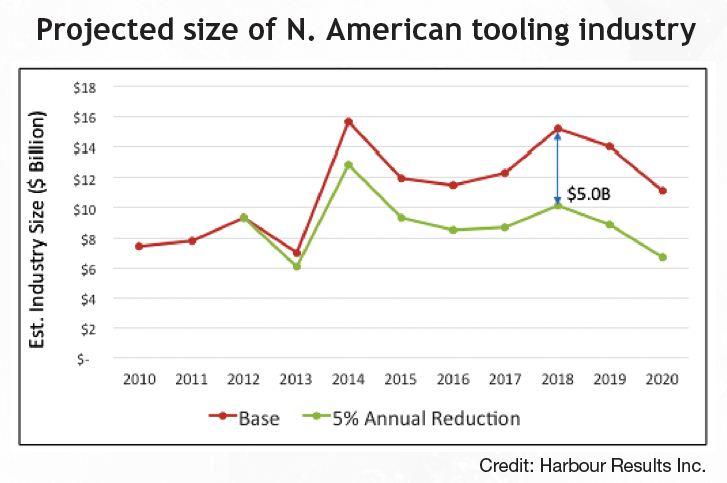

According to the 2013 Vendor Tooling Study by Royal Oak, Mich.-based automotive market research firm Harbour Results Inc. (HRI) and the Original Equipment Suppliers Association, in approximately five years the required capacity of the vendor tooling industry will reach US$15.2 billion, with available current supply of only US$9.25 billion. Vendor tooling — tooling purchased by the OEM to be run in Tier 1 or Tier 2 facilities — is a crucial part of the automotive industry and the vehicle development process, accounting for an average of US$550 per vehicle in North America at 2012 vehicle volume.

“Capacity will become a serious challenge for the automotive industry in the near future,” said Laurie Harbour, HRI’s president and CEO. “If the North American tooling industry doesn’t respond to the challenge, someone else — such as European and Asian tooling suppliers — will,”

The study — which gathered information from 10 OEMs, nearly 50 major Tier 1 suppliers, and more than 50 global tooling suppliers — identifies several factors that will contribute to the demand increase, including mass customization, increased complexity, European and Asian OEM tool localization to North America, increased vehicle content, a looming skills shortage, and increased price pressure.

THE VIEW THROUGH THE WINDSHIELD

The study begins by sketching the current state of North America’s automotive and automotive tooling industries. “The global economy has been gradually recovering from the 2009 recession, and near-term global vehicle demand holds in positive territory, but the picture is mixed across the landscape,” the report said. “Sales in North America (rising seven per cent to 18.4 million units) and Asia (rising five per cent to 35.7 million units, driven by China at 11 per cent or 21.3 million units) saw the largest growth in 2013. The balance of the regions remained flat or saw a drop in light vehicle sales. In total, global light vehicle sales increased four per cent to 83.4 million units.”

Forecasts of vehicle production growth indicate that Asia will remain dominant and, specifically, China will continue to be the most rapidly growing area. “From 2012 to 2017, global vehicle capacity will increase from 111.7 million units to 134.7 million units,” the study said. “Regional production will be driven by emerging growth and mature recovery. Globalization and localization will shape future vehicle production.”

For the first time since 2002, the study continued, North American production hit 16 million units in 2013, which included a four per cent growth in production volume from 2012 (15.4 million units) to 2013 (16.1 million units). North American light vehicle sales will continue with gradual growth for the remainder of the decade. “U.S. growth will be spurred by retail sales, which should outpace expectations,” the study said. “By 2020, the projection is that the North American sales

volume will be more than 20 million units — numbers that this market has not seen before — with the largest percentage of growth forecast to come from Mexico, which is expected to grow by 10 per cent.”

The key dynamic in the North American auto industry for the last several years has been the change in consumer taste, the study noted. “Vehicle owners are looking for something very different in their automobiles than in the past,” the study said. “These new consumers want customized, exciting new features and technology. This has driven tremendous complexity into vehicle offerings and the need for mass customization. In response, automotive OEMs are designing more models from common platforms and increasing the vehicle mix, while producing fewer vehicles per model. As a result, there will be fewer vehicle platforms with more models, an increased number of trim packages, and more options than ever before.”

The problem? As mentioned above, there’s a capacity constraint coming, and it’s going to put a serious crimp in the industry’s ability to satisfy these projections.

HANDLING THE CURVES

So how does the industry rise to the challenge? The report recommends a three-pronged approach. First, Harbour said, the industry would see a 10 to 20 per cent reduction in absolute tool costs if there was more collaboration between OEMs, Tier 1s, and tooling suppliers as early as 36 months before vehicle launch. “Increased collaboration leads to improved manufacturing feasibility, increased input on part design, improved understanding of supplier capabilities, and more,” Harbour said. “Modifying processes throughout the vendor tooling value stream will not only improve tooling cost, but, more importantly, improve capacity needed to offset the impending constraint. OEMs, Tier 1s, and tooling suppliers will need to work together to create more efficient practices and reduce wastes throughout the entire process, from planning through to development, kick-off, production and beyond to address the entire capacity gap.”

Second, there needs to be an industry-wide focus shift away from price and towards cost. “Too often today, the industry is focused on the increased price pressures and the price of tools, rather than the cost created throughout the entire tooling value stream — OEMs are utilizing a number of different tactics to lower the price of tools and services, including adjustment of payment terms and low-cost country sourcing,” Harbour said. “Seeking lower prices, especially with low-cost countries, is not the answer. The advantage gap for countries like China has been shrinking and will continue to shrink. China is still an option for tools, but high complexity, critical tools will stay here. If the focus does not shift to managing costs, the industry will face incredible challenges as capacity grows in this region.”

And third, the industry has to find, and eliminate, inefficiencies in the value stream. “OEMs, Tier 1s, and tooling suppliers need to analyze the entire value stream to identify key areas of improvement,” Harbour explained. “Inefficiencies, such a multiple or late-in-the-game engineering redesigns, come with a significant cost that could be avoided by adjusting current processes. A majority of the costs associated with the vendor tooling value stream are a result of process wastes and, when improved, can make a considerable difference to the overall cost of the industry.”

THE ROAD AHEAD

Getting more specific, the study examines the respective steps that OEMs, Tier 1 suppliers, and tool suppliers are going to have to take to better adapt themselves to this brave new world.

“OEMs have to decide what needs to evolve within their strategies and tactics to secure their portion of capacity among tool suppliers,” the report said. “Are progressive payments critical to secure capacity? What are the most important modifications of strategic elements that will develop long-term relationships and allow tool suppliers the comfort they need to commit to upfront involvement in the design process?

For newer OEM entrants to North America, it’s critical to develop the strategy to break into this tool supply base and create the right relationships.”

Tier 1 suppliers, meanwhile, have to decide what role they want to play. “As the middleman, many have actually talked about making their own tools directly and are investigating putting in their own tool shops today,” the study said. “This may or may not be the right decision, and in some cases the OEMs will not be excited about this possibility, but the Tier 1 companies have a difficult role to play between the tool supplier and the OEM. In the end, they have the right to make profit for management of tools, and they have the responsibility to manage that effectively and appropriately.”

And last but definitely not least, the tool suppliers have to decide if they want to evolve and work on what they control, invest more in those relationships, and support this future gap in capacity. “Tool suppliers have to strategically

start asking their customers, ‘What is it about you that makes me want to do business with you?’”, the study said.

The key for all three stakeholders — particularly the OEMs — is consistency of strategy, the study said: “If they change after one attempt, why would suppliers and tool suppliers continue to follow them, and how would things actually change in the long run?” Additionally, OEMs have to focus on a strategy that’s right for them and not try to borrow one from the firm down the road. “Every company has a different culture, and the strategy has to fit the culture of that company,” the report said.

If the findings of the Harbour report strike you as Stephen King-style scary, you can semi-relax: it all ends on a positive note. “If the stakeholders are able to achieve the recommended collaborations, the vendor tool industry in North America will meet the future demand; the industry will keep a large manufacturing base in North America; the skills gap will be minimized, reducing the crisis in the country; OEMs will be able to invest in more products, in particular low-volume models that are typically cut due to high investment budgets; and new technologies, such as aluminum tools, will be able to be implemented,” it concluded.

It might just be the nearest thing to a happy ending the North American auto sector has experienced in years.

For the full HRI 2013 Vendor Tooling Study, or for more information, contact Harbour Results Inc. at info@harbourresults.com or 248-629-9331.

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI